2024 Home & Auto Insurance Outlook

It is critical that as your agent, we understand insurance rate expectations in 2024. In turn, sharing that knowledge to keep you informed is equally important.

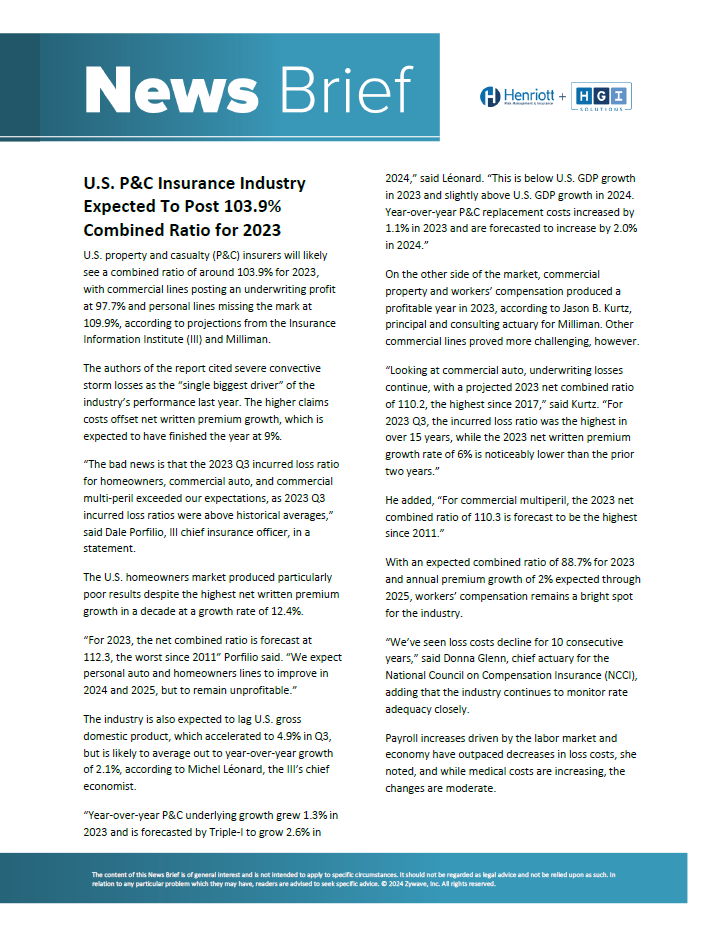

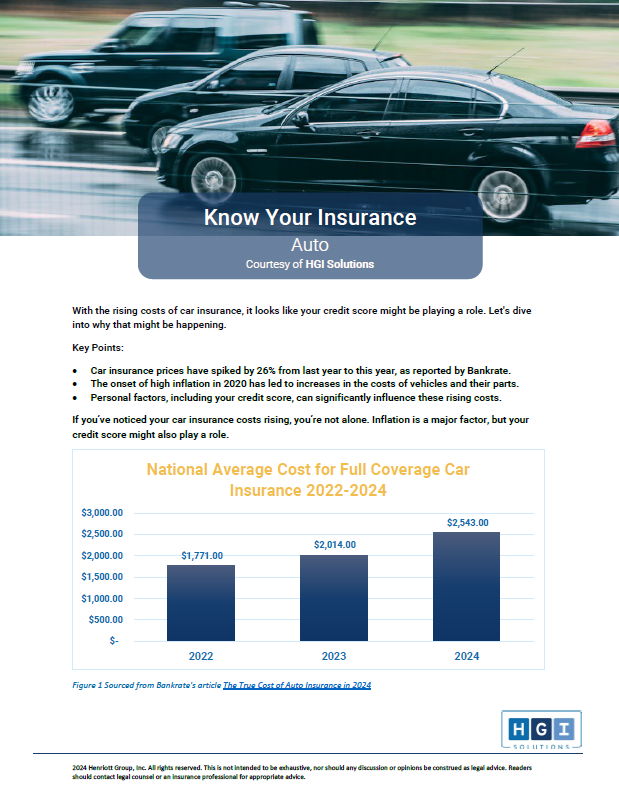

In 2024, U.S. insurance losses reached $92.9 billion. We are seeing insurance carriers nationwide tighten their restrictions on underwriting home and auto risks, with some carriers even placing moratoriums on writing new business. Others are adjusting their guidelines for what they consider to be an "acceptable risk." This is a widespread challenge affecting every insurance agency and broker in the United States.

We feel the following resources are a good start to prepare you for what we may see in your upcoming renewals. As insureds ourselves, we are in this with you and feel the same frustration. We will not know how this continued hard market will impact your own policies until 30 days prior to your renewal date. If we see that you will be negatively impacted with a high renewal rate, we will work with other carriers on your behalf.

Why Are Home and Auto Insurance Rates Rising?

7 Ways to Reduce Home Insurance Costs

7 Ways to Reduce Auto Insurance Costs